when to expect unemployment tax break refund 2021

If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund starting in May if you qualify. The IRS has sent 87 million unemployment compensation refunds so far.

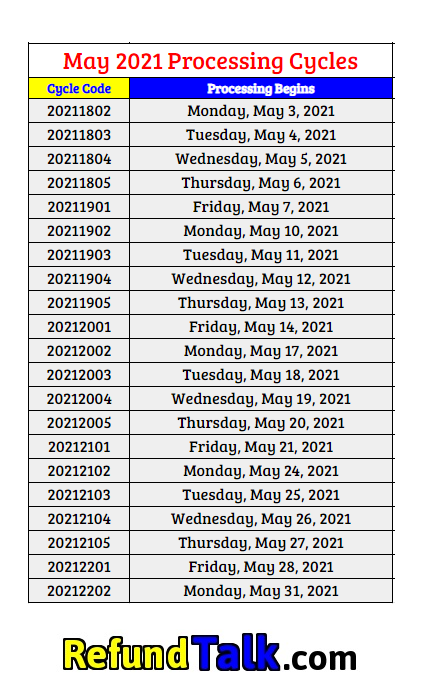

2021 Tax Transcript Cycle Code Charts Where S My Refund Tax News Information

IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns. IRS to recalculate taxes on unemployment benefits. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the. The IRS has announced that it will continue to process refunds for those individuals. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received in 2020 from federal income tax for households reporting an adjusted gross income less than 150000 on their 2020 tax return.

When to expect your unemployment refund. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Tax season started Jan.

Refunds are expected to begin in May. Refunds to start in May. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

The full amount of your benefits should appear in box 1 of the form. 2 2021 100 pm. The IRS will automatically refund filers who are entitled to an unemployment tax break but that money wont come for a.

The federal tax code counts jobless benefits. Refunds are the result of. You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for the unemployment income you received in 2021.

24 and runs through April 18. 2021 tax refund The IRS will begin in May to send tax refunds in two waves to those who benefited from the 10200 unemployment tax break for claims in 2020. As of December 28 the IRS already issued tax refunds worth 145 billion to more than 118 million households.

But it notes that as it continues to review more complex returns the process will continue into 2022. For this round the average refund is 1686 direct deposit refunds started going out Wednesday and paper checks today. Tax refunds on unemployment benefits to start in May.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Depending on whether you fall into the first or second wave these payments will continue into the summer. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

The update says that to date the. IR-2021-71 March 31 2021. The recently-signed 19 trillion American Rescue.

After more than three months since the IRS last sent adjustments on. The IRS started sending another 15 million tax refunds to people who overpaid federal taxes on unemployment benefits received in 2020. If you filed your taxes electronically you may receive an electronic refund deposited straight to your bank account.

Unemployment tax break refund coming in May. The exclusion applied to individuals and married couples whose modified adjusted gross income was less than 150000. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

The first batch of refunds will go to single taxpayers who qualify for the unemployment tax break the IRS said. May 14 2021 1239 PM. The IRS will automatically refund filers who are entitled to an unemployment tax break but that money wont come for a while.

The IRS will receive a copy of your Form 1099-G as well so it will know how much you received. If you claimed unemployment last year but filed your. Expect It in May.

Irs Unemployment Refund Update How To Track And Check Its State As Usa

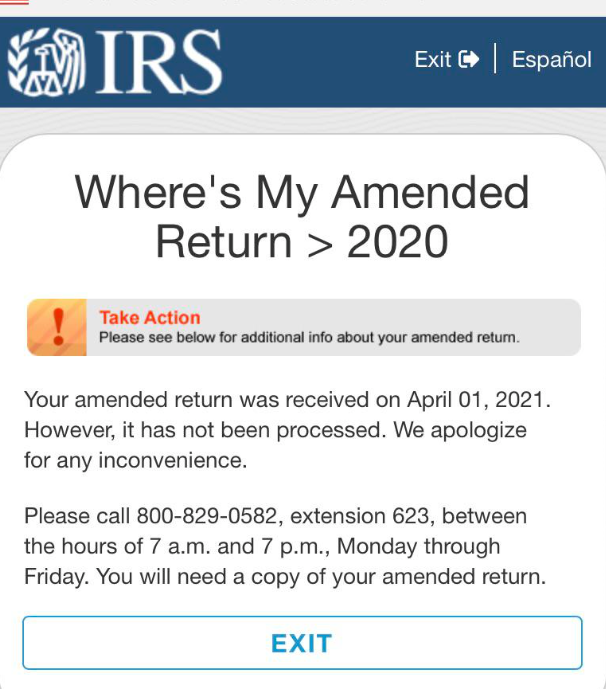

Where Is My Amended Tax Return And When Will I Get My Refund Checking 2022 Payment Status And Direct Deposit Aving To Invest

Tax Season 2021 Is Open And Comes With A Lot Of Issues The Washington Post

![]()

Recovery Rebate Credit And 2021 Economic Impact Payments Tas

When Will Irs Send Unemployment Tax Refunds 11alive Com

Unemployment Tax Break 2022 A New Unemployment Income Tax Exclusion Coming Marca

When Will Irs Send Unemployment Tax Refunds 11alive Com

End Of Year Tax Planning 2021 Albany Business Review

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

Third Stimulus Check Update When You Can Expect Your Check

2021 Taxes And New Tax Laws H R Block

What You Need To Know To File Taxes In 2022 Get It Back

Irs Code 846 What Does Code 846 Refund Issued Mean On 2021 2022 Transcript

You Could Be Receiving An Unemployment Tax Refund From The Irs

When Will Irs Send Unemployment Tax Refunds 11alive Com

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

Here Are Some Changes To Expect When You File Next Year Tax Taxes Standard Deduction Required Minimum Distribution Retirement Accounts

Tax Refund Delays Where Is Your Money And How To Track It Warady Davis Llp